Remember, retirement income planning is complex and personal.

It's advisable to consult with financial and tax professionals

to create a tailored plan that meets your specific needs and goals.

Financial security: Retirement income planning helps ensure you have enough money to maintain your desired lifestyle after you stop working. It allows you to create a financial backup for emergencies and unexpected expenses in your later years

Tax advantages: Many retirement plans offer significant tax benefits. Contributions to certain retirement accounts can reduce your current taxable income, and investment gains are often not taxed until distributed

Peace of mind: A well-structured retirement income plan provides financial independence and peace of mind, allowing you to enter your retirement years with confidence and without financial worries

Flexibility and control: Retirement income planning allows you to tailor your savings and investment strategy to your specific needs and goals. This includes the possibility of early retirement if desired

Legacy opportunities: Proper retirement planning can help you leave a financial legacy for your heirs or contribute to charitable causes that are important to you

Frequently Asked Questions

How much money do I need to retire?

There's no one-size-fits-all answer, but a rough estimate can be calculated by dividing your desired annual retirement income by 4%. For example, if you want $100,000 per year in retirement, you might aim for $2.5 million in savings. However, this amount can vary based on factors such as your intended lifestyle, potential healthcare costs, and other income sources

What will my expenses look like as a retiree?

To forecast retirement expenses, start by tracking your current monthly bills and consider additional costs such as vacations, gifts, healthcare, long-term care, and emergency spending. It's important to factor in both fixed expenses (e.g., food, housing, insurance) and discretionary expenses

What are my sources of retirement income?

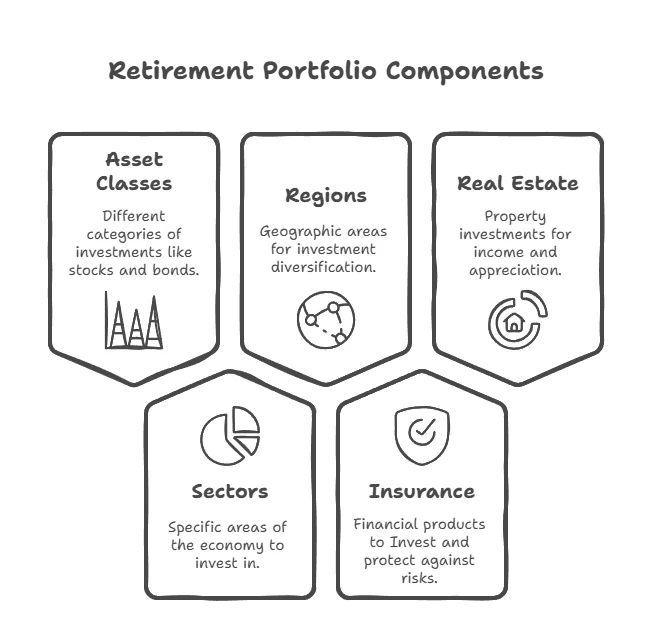

Retirement income can come from various sources, including:

Retirement savings (IRAs, 401(k)s, 403(b)s, 457 plans)

Non-retirement savings and investments

Social Security benefits

Traditional pension plans

Annuities

Insurance as an Asset Class

Full- or part-time employment

Real estate

other income-generating assets

How should I plan my withdrawal strategy?

While the 4% withdrawal rule is a common guideline, it may not fit everyone's situation. Consider a flexible approach based on your portfolio's performance, spending needs, and lifestyle. Factors to consider include:

Short-term income needs

Potential tax implications

Maintaining your portfolio allocation

Required Minimum Distributions (RMDs) from tax-deferred accounts

©2025 Copyright. All rights reserved